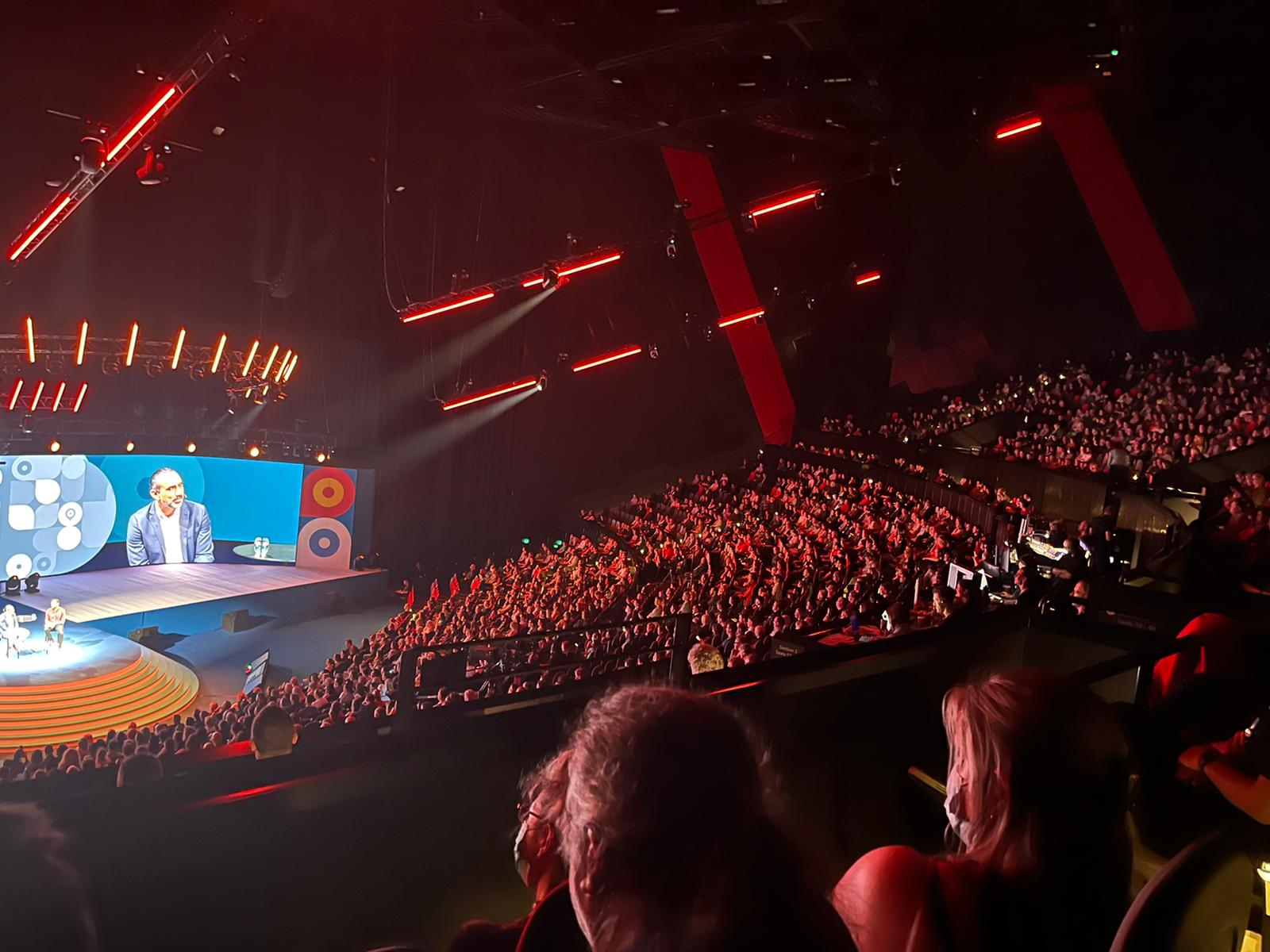

Merry Christmas and Happy New Year With the festive season upon us, we would like to take the opportunity to thank all our clients for their continued support and wish everyone a merry Christmas and prosperous new year. 2022 has certainly had its challenges, with rising input costs, rising interest rates and a tight labour market, not to mention the continuing wet conditions and widespread flooding across the region. Yet despite these challenges we have seen many of our clients continue to grow and prosper. At Peacocke’s, we continue to grow as well, with Ian Horsburgh (Ted) joining the firm during the year, and we are looking forward to announcing some exciting new service offerings in 2023.   Flood Grants Flood GrantsMany of our clients have been affected by the severe flooding that continued through September, October and November (and some still experiencing it today). With the continued flooding, there have been a number of new emergency declarations made and a number of grants and loans are available. Importantly, if your business has been impacted multiple times you may be eligible for multiple grants and/or loans. If multiple grants are applied for it is important to note that the second grant will not be funded until all the funds from the first grant have been exhausted (supported by receipts). We have also been informed that the RAA is likely to undertake audit activity in 2023 to ensure that funds are being utilised as per the program criteria and approval. Further details can be found at https://www.raa.nsw.gov.au/disaster-assistance/storm-and-flood-programs or contact our office to discuss.    Xerocon In September, Ted and John took the trip to Sydney to attend Xerocon. Xerocon is the largest accounting technology conference in Australasia with over 5,000 accountants and bookkeepers attending. It’s about educating and inspiring a new generation of accountants and bookkeepers with the possibilities afforded by cloud software solutions. We look forward to sharing these learnings with our clients into the future to make accounting and compliance easier in your business and reporting to help you better understand what makes your business efficient and profitable. Xero Verify With a continued focus on internet security, Xero have now introduced their own multi-factor authentication via the Xero Verify App. The Xero Verify app is simple to use and you can receive push notifications for fast authentication, instead of having to open the app and enter a code into Xero. If you would like to use this type of authentication, please follow the instructions in the link https://www.xero.com/au/security/multi-factor-authentication/ or contact our office to discuss. Fuel Tax Credits (FTC) and Superannuation Payments Just a reminder that with the Federal Government restoring the full fuel tax excise on 29th September 2022, this has an impact on the level of Fuel Tax Credits that can be claimed. From the 29th September 2022, the off-road FTC increased to $0.46/L and on-road to $0.188/L. It is common for the ATO to conduct FTC reviews and we expect increased activity with the lodgement of the December BAS so ensure that the correct amount of FTC is claimed in the BAS. Also, just a reminder that although the December BAS isn’t due until 28th February, compulsory super payments are due 28th January 2023. If you require assistance in finalising payroll and determining your superannuation liability for the quarter, please reach out in early January 2023. |